Technological change in energy - POLES: Difference between revisions

No edit summary |

mNo edit summary |

||

| (3 intermediate revisions by the same user not shown) | |||

| Line 5: | Line 5: | ||

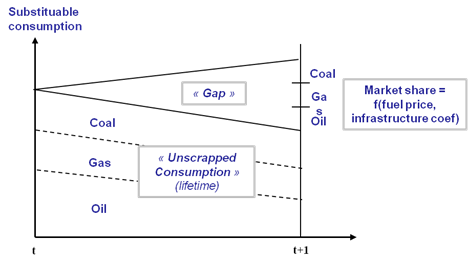

Technological change in the various sectors takes place through competition in the new capacity planning ("gap", multinominal logit), which depends on expected utilisation costs of the competing technologies (myopic anticipation, no perfect foresights). Technological change is constrained by the vintage of existing capital stock ("unscrapped consumption") and resource availability. In addition to upgrading possibility, accelerated retirement can be considered in some specific cases (e.g. some coal plants in the power generation sector). | Technological change in the various sectors takes place through competition in the new capacity planning ("gap", multinominal logit), which depends on expected utilisation costs of the competing technologies (myopic anticipation, no perfect foresights). Technological change is constrained by the vintage of existing capital stock ("unscrapped consumption") and resource availability. In addition to upgrading possibility, accelerated retirement can be considered in some specific cases (e.g. some coal plants in the power generation sector). | ||

[[File:Scrap-gap.png|none| | <figure id="fig:POLES_8"> | ||

[[File:Scrap-gap.png|none|600px|thumb|<caption>Schematic of the energy needs and depreciation procedure in POLES</caption>]] | |||

</figure> | |||

Costs usually consider fixed costs (investment, lifetime, O&M, discount rate) and variable costs (fuel price, efficiency, O&M). | Costs usually consider fixed costs (investment, lifetime, O&M, discount rate) and variable costs (fuel price, efficiency, O&M). | ||

| Line 12: | Line 14: | ||

It must be noted that the competition also considers, in addition to the cost component, a "reality parameter" that is calibrated (directly in the model or with external procedures) to replicate the historical situation given used cost estimates. This parameter is essential to compensate for imperfect cost estimates or to capture drivers of economic decisions that are poorly or not at all represented in the model (national industrial policy choices, etc..). The model also includes the possibility to test "network effect" for new technologies (accelerated adoption beyond some market share threshold). | It must be noted that the competition also considers, in addition to the cost component, a "reality parameter" that is calibrated (directly in the model or with external procedures) to replicate the historical situation given used cost estimates. This parameter is essential to compensate for imperfect cost estimates or to capture drivers of economic decisions that are poorly or not at all represented in the model (national industrial policy choices, etc..). The model also includes the possibility to test "network effect" for new technologies (accelerated adoption beyond some market share threshold). | ||

Future scenarios with technological change have been studied with the model in several reports[[CiteRef::EC 2003]][[CiteRef::EC 2006]][[CiteRef::wiesenthal2012a]][[CiteRef::criqui2015mi]]. | |||

Latest revision as of 12:45, 3 February 2017

| Corresponding documentation | |

|---|---|

| Previous versions | |

| Model information | |

| Model link | |

| Institution | JRC - Joint Research Centre - European Commission (EC-JRC), Belgium, http://ec.europa.eu/jrc/en/. |

| Solution concept | Partial equilibrium (price elastic demand) |

| Solution method | SimulationRecursive simulation |

| Anticipation | Myopic |

Technological change in the various sectors takes place through competition in the new capacity planning ("gap", multinominal logit), which depends on expected utilisation costs of the competing technologies (myopic anticipation, no perfect foresights). Technological change is constrained by the vintage of existing capital stock ("unscrapped consumption") and resource availability. In addition to upgrading possibility, accelerated retirement can be considered in some specific cases (e.g. some coal plants in the power generation sector).

<figure id="fig:POLES_8">

</figure>

Costs usually consider fixed costs (investment, lifetime, O&M, discount rate) and variable costs (fuel price, efficiency, O&M).

Investment costs can be exogenously set or endogenously simulated through learning curves (1 or 2-factors learning curves) depending on the sector.

It must be noted that the competition also considers, in addition to the cost component, a "reality parameter" that is calibrated (directly in the model or with external procedures) to replicate the historical situation given used cost estimates. This parameter is essential to compensate for imperfect cost estimates or to capture drivers of economic decisions that are poorly or not at all represented in the model (national industrial policy choices, etc..). The model also includes the possibility to test "network effect" for new technologies (accelerated adoption beyond some market share threshold).

Future scenarios with technological change have been studied with the model in several reportsEC 2003EC 2006wiesenthal2012acriqui2015mi.