Macro-economy - POLES: Difference between revisions

Jump to navigation

Jump to search

No edit summary |

mNo edit summary |

||

| (3 intermediate revisions by 2 users not shown) | |||

| Line 3: | Line 3: | ||

|DocumentationCategory=Macro-economy | |DocumentationCategory=Macro-economy | ||

}} | }} | ||

The key marco-economic assumptions are derived from population and GDP. | |||

Starting from historical data, which capture local specificities, sectoral economic activity variables are calculated: | |||

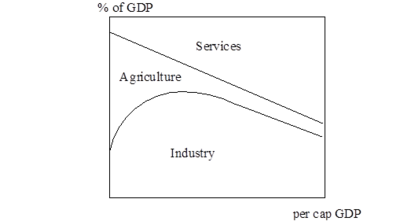

* sectoral value added: depend on the level of development of the country/region, given by GDP per capita (industrialization phase followed by service-based economy); | |||

* industrial physical production: depend on demand, which itself depends on the level of development; | |||

* mobility (for passengers and for goods): depend on the cost of transport compared to income, and is declined in equipment rates and degree of utilisation of this equipment; | |||

* buildings surfaces: depend on households size (occupancy per dwelling) and surface per dwelling, both depending on personal income. | |||

<figure id="fig:POLES_4"> | |||

[[File:36405548.png|none|400px|thumb|<caption>Share of value-added as a function of GDP per capita</caption>]] | |||

[[ | </figure> | ||

Latest revision as of 16:37, 22 December 2016

| Corresponding documentation | |

|---|---|

| Previous versions | |

| Model information | |

| Model link | |

| Institution | JRC - Joint Research Centre - European Commission (EC-JRC), Belgium, http://ec.europa.eu/jrc/en/. |

| Solution concept | Partial equilibrium (price elastic demand) |

| Solution method | SimulationRecursive simulation |

| Anticipation | Myopic |

The key marco-economic assumptions are derived from population and GDP.

Starting from historical data, which capture local specificities, sectoral economic activity variables are calculated:

- sectoral value added: depend on the level of development of the country/region, given by GDP per capita (industrialization phase followed by service-based economy);

- industrial physical production: depend on demand, which itself depends on the level of development;

- mobility (for passengers and for goods): depend on the cost of transport compared to income, and is declined in equipment rates and degree of utilisation of this equipment;

- buildings surfaces: depend on households size (occupancy per dwelling) and surface per dwelling, both depending on personal income.

<figure id="fig:POLES_4">

</figure>