Trade - REMIND-MAgPIE: Difference between revisions

Laura Delsa (talk | contribs) No edit summary |

Laura Delsa (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

{{ModelDocumentationTemplate | {{ModelDocumentationTemplate | ||

|IsEmpty=No | |||

|IsDocumentationOf=REMIND | |IsDocumentationOf=REMIND | ||

|DocumentationCategory=Trade | |DocumentationCategory=Trade | ||

}} | }} | ||

REMIND considers the trade of coal, gas, oil, biomass, uranium, the composite good (aggregated output of the macro-economic system), and emissions permits (in the case of climate policy). It assumes that renewable energy sources (other than biomass) and secondary energy carriers are non-tradable across regions. As an exception, REMIND can consider bilateral trade in electricity between specific region pairs (e.g., Europe and North Africa / Middle East). According to energy statistics, trade in refined liquid fuels does take place in the real world, but to a smaller extent than crude oil. Since REMIND considers crude oil trade, the liquid fuel trade only has a small share and is attributed to crude oil trade. To be consistent with trade statistics, REMIND allocates the trade in petroleum products to crude oil trade. | REMIND considers the trade of coal, gas, oil, biomass, uranium, the composite good (aggregated output of the macro-economic system), and emissions permits (in the case of climate policy). It assumes that renewable energy sources (other than biomass) and secondary energy carriers are non-tradable across regions. As an exception, REMIND can consider bilateral trade in electricity between specific region pairs (e.g., Europe and North Africa / Middle East), but this is not part of the default scenario. According to energy statistics, trade in refined liquid fuels does take place in the real world, but to a smaller extent than crude oil. Since REMIND considers crude oil trade, the liquid fuel trade only has a small share and is attributed to crude oil trade. To be consistent with trade statistics, REMIND allocates the trade in petroleum products to crude oil trade. | ||

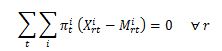

Within the Negishi approach, for each good i a global trade balance equation ensures that markets are cleared: | |||

[[File:REMIND trade 1.JPG]] | [[File:REMIND trade 1.JPG]] | ||

REMIND models regional trade via a common pool, with the exception of the bilateral | REMIND models regional trade via a common pool, with the exception of the bilateral electricity trade mentioned above. While each region is an open system - meaning that it can import more than it exports - the global system is closed. The combination of regional budget constraints and international trade balances ensures that the sum of regional consumption, investments, and energy-system expenditures cannot be greater than the global total output in each period. In line with the classical Heckscher-Ohlin and Ricardian models (Heckscher et al. 1991), trade between regions is induced by differences in factor endowments and technologies. REMIND also represents the additional possibility of inter-temporal trade. This can be interpreted as capital trade or borrowing and lending. | ||

For each region, the value of exports must balance the value of imports within the time horizon of the model. This is ensured by the inter-temporal budget constraint, where πir is the present value price of good i. | |||

[[File:REMIND trade 2.JPG]] | [[File:REMIND trade 2.JPG]] | ||

In this equation discounting is implicit by using present value prices. | |||

Inter-temporal trade and the capital mobility implied by trade in the composite good, cause prices of mobile factors to equalize, thus providing the basis for an inter-temporal and inter-regional equilibrium. Since no capital market distortions are considered, the interest rates equalize across regions. Similarly, permit prices equalize across regions, unless their trade is restricted. By contrast, final energy prices and wages can differ across regions because these factors are immobile. Prices for traded primary energy carriers differ according to the transportation costs. | |||

[[File:REMIND trade 3.JPG]] | [[File:REMIND trade 3.JPG]] | ||

Trade balances imply that the regional current accounts (and their counterparts - capital accounts) have a sum of zero at each point in time. In other words, regions with a current account surplus balance regions with a current account deficit. | Trade balances imply that the regional current accounts (and their counterparts - capital accounts) have a sum of zero at each point in time. In other words, regions with a current account surplus balance regions with a current account deficit. The inter-temporal budget constraints clear debts and assets that accrue through trade over time. This means that an export surplus qualifies the exporting region for an import surplus (of the same present value) in the future, thus also implying a loss of consumption for the current period. REMIND models trading of emissions permits in a similar way. In the presence of a global carbon market, the initial allocation of emissions rights is determined by a burden-sharing rule wherein permits can be freely traded among world regions. A permit-constraint equation ensures that an emissions certificate covers each unit of GHG emissions. Trade of resources is subject to trade costs. In terms of consumable generic goods, the representative households in REMIND are indifferent to domestic and foreign goods as well as foreign goods from different origins. This can potentially lead to a strong specialization pattern. | ||

The treatment of trade in REMIND depends on the solution concept (Nash vs. Negishi). The two approaches are in a dual relationship. The Negishi approach considers the trade balances of all goods explicitly and adjusts the welfare weights in order to guarantee that the intertemporal balance of payments of each region is settled. REMIND derives the prices of traded goods from the optimal solution in each iteration. The Nash approach adjusts goods prices until demand and supply of traded goods are equalized. In each iteration, the international prices are exogenous parameters for all regions. Furthermore, each region is subject to an intertemporal budget constraint, i.e. the intertemporal balance of payments has to be equal to zero. | The treatment of trade in REMIND depends on the solution concept (Nash vs. Negishi). The two approaches are in a dual relationship. The Negishi approach considers the trade balances of all goods explicitly and adjusts the welfare weights in order to guarantee that the intertemporal balance of payments of each region is settled. REMIND derives the prices of traded goods from the optimal solution in each iteration. The Nash approach adjusts goods prices until demand and supply of traded goods are equalized. In each iteration, the international prices are exogenous parameters for all regions. Furthermore, each region is subject to an intertemporal budget constraint, i.e. the intertemporal balance of payments has to be equal to zero. | ||

Table | '''Table 2.''' Characterization of the treatment of trade in the two alternative Negishi and Nash solution concepts. | ||

[[File:REMIND trade 4.JPG]] | [[File:REMIND trade 4.JPG]] | ||

Revision as of 18:33, 20 November 2016

| Corresponding documentation | |

|---|---|

| Previous versions | |

| Model information | |

| Model link | |

| Institution | Potsdam Institut für Klimafolgenforschung (PIK), Germany, https://www.pik-potsdam.de. |

| Solution concept | General equilibrium (closed economy)MAgPIE: partial equilibrium model of the agricultural sector; |

| Solution method | OptimizationMAgPIE: cost minimization; |

| Anticipation | |

REMIND considers the trade of coal, gas, oil, biomass, uranium, the composite good (aggregated output of the macro-economic system), and emissions permits (in the case of climate policy). It assumes that renewable energy sources (other than biomass) and secondary energy carriers are non-tradable across regions. As an exception, REMIND can consider bilateral trade in electricity between specific region pairs (e.g., Europe and North Africa / Middle East), but this is not part of the default scenario. According to energy statistics, trade in refined liquid fuels does take place in the real world, but to a smaller extent than crude oil. Since REMIND considers crude oil trade, the liquid fuel trade only has a small share and is attributed to crude oil trade. To be consistent with trade statistics, REMIND allocates the trade in petroleum products to crude oil trade.

Within the Negishi approach, for each good i a global trade balance equation ensures that markets are cleared:

REMIND models regional trade via a common pool, with the exception of the bilateral electricity trade mentioned above. While each region is an open system - meaning that it can import more than it exports - the global system is closed. The combination of regional budget constraints and international trade balances ensures that the sum of regional consumption, investments, and energy-system expenditures cannot be greater than the global total output in each period. In line with the classical Heckscher-Ohlin and Ricardian models (Heckscher et al. 1991), trade between regions is induced by differences in factor endowments and technologies. REMIND also represents the additional possibility of inter-temporal trade. This can be interpreted as capital trade or borrowing and lending. For each region, the value of exports must balance the value of imports within the time horizon of the model. This is ensured by the inter-temporal budget constraint, where πir is the present value price of good i.

In this equation discounting is implicit by using present value prices. Inter-temporal trade and the capital mobility implied by trade in the composite good, cause prices of mobile factors to equalize, thus providing the basis for an inter-temporal and inter-regional equilibrium. Since no capital market distortions are considered, the interest rates equalize across regions. Similarly, permit prices equalize across regions, unless their trade is restricted. By contrast, final energy prices and wages can differ across regions because these factors are immobile. Prices for traded primary energy carriers differ according to the transportation costs.

Trade balances imply that the regional current accounts (and their counterparts - capital accounts) have a sum of zero at each point in time. In other words, regions with a current account surplus balance regions with a current account deficit. The inter-temporal budget constraints clear debts and assets that accrue through trade over time. This means that an export surplus qualifies the exporting region for an import surplus (of the same present value) in the future, thus also implying a loss of consumption for the current period. REMIND models trading of emissions permits in a similar way. In the presence of a global carbon market, the initial allocation of emissions rights is determined by a burden-sharing rule wherein permits can be freely traded among world regions. A permit-constraint equation ensures that an emissions certificate covers each unit of GHG emissions. Trade of resources is subject to trade costs. In terms of consumable generic goods, the representative households in REMIND are indifferent to domestic and foreign goods as well as foreign goods from different origins. This can potentially lead to a strong specialization pattern. The treatment of trade in REMIND depends on the solution concept (Nash vs. Negishi). The two approaches are in a dual relationship. The Negishi approach considers the trade balances of all goods explicitly and adjusts the welfare weights in order to guarantee that the intertemporal balance of payments of each region is settled. REMIND derives the prices of traded goods from the optimal solution in each iteration. The Nash approach adjusts goods prices until demand and supply of traded goods are equalized. In each iteration, the international prices are exogenous parameters for all regions. Furthermore, each region is subject to an intertemporal budget constraint, i.e. the intertemporal balance of payments has to be equal to zero.

Table 2. Characterization of the treatment of trade in the two alternative Negishi and Nash solution concepts.