Fossil energy resources - REMIND-MAgPIE

| Corresponding documentation | |

|---|---|

| Previous versions | |

| Model information | |

| Model link | |

| Institution | Potsdam Institut für Klimafolgenforschung (PIK), Germany, https://www.pik-potsdam.de. |

| Solution concept | General equilibrium (closed economy)MAgPIE: partial equilibrium model of the agricultural sector; |

| Solution method | OptimizationMAgPIE: cost minimization; |

| Anticipation | |

Exhaustible resources

REMIND-MAgPIE characterizes exhaustible resources such as coal, oil, gas, and uranium in terms of extraction cost curves. Fossil resources (e.g., oil, coal, and gas) are further defined by decline rates and adjustment costs [1]. Extraction costs increase over time as low-cost deposits become exhausted [2], [3]; [4]; [5]; [6]. In REMIND-MAgPIE, we use region-specific extraction cost curves that relate production cost increases to cumulative extraction [7]; [8].

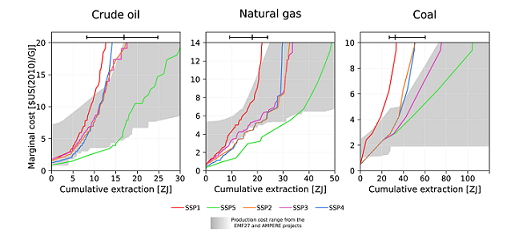

<xr id="fig:REMIND-MAgPIE_5"/> shows extraction cost curves at the global level as implemented for various SSPs. More details on the underlying data and method will be presented in a separate pape [9]. The default scenario used in REMIND-MAgPIE is SSP2 (“Middle-of-the-Road”). In the model, these fossil extraction cost input data are approximated by piecewise linear functions that are employed for fossil resource extraction curves. Additionally, as a scenario choice, it is possible to make oil and gas extraction cost curves time dependent. This means that resources and costs may increase or decrease over time depending on expected future conditions such as technological and geopolitical changes.

For uranium, extraction costs follow a third-order polynomial parameterization. The amount of available uranium is limited to 23 Mt. This resource potential includes reserves, conventional resources, and a conservative estimate of unconventional resources [10].

REMIND-MAgPIE prescribes decline rates for the extraction of coal, oil, and gas. In the case of oil and gas, these are dynamic extraction constraints based on data published by the International Energy Agency [11]; [12]. An additional dynamic constraint limits the extraction growth of coal, oil, and gas to 10% per year. In addition, we use adjustment costs to represent short-term price markups resulting from rapid expansion of resource production [13]; [14]; [15].

<figure id="fig:REMIND-MAgPIE_5">

</figure>

</figure>

Figure 1: Global aggregate Cumulative Availability Curves of coal, oil and gas for the different SSPs. The bars at the top indicate the minimum, median and maximum extraction in baseline scenarios in the EMF-27 study; the shaded area covers the range of extraction cost functions given in the EMF-27 and AMPERE studies.

Trade costs in REMIND-MAgPIE are both region-and resource-specific. Oil trade costs range between 0.22 USD/GJ in AFR and 0.63 USD/GJ in EUR. Gas trade costs are lowest in EUR and JPN with a value of 1.52 USD/GJ and reach a maximum in CHN with a value of 2.16 USD/GJ. Coal trade costs range between 0.54 USD/GJ in JPN and 0.95 USD/GJ in IND.

- ↑ Bauer N, Mouratiadou I, Luderer G, et al (2013) Global fossil energy markets and climate change mitigation – an analysis with REMIND-MAgPIE. Climatic Change in press. doi: 10.1007/s10584-013-0901-6

- ↑ Herfindahl OC (1967) Depletion and Economic Theory. In: Extractive Resources and Taxation. M. Gaffney (Ed.), University of Wisconsin Press, Madison, Wisconsin

- ↑ Rogner H-H (1997) An assessment of world hydrocarbon ressources. Annual Review of Energy and the Environment 22:217–262. doi: 10.1146/annurev.energy.22.1.217

- ↑ Aguilera RF, Eggert RG, C. C. GL, Tilton JE (2009) Depletion and the Future Availability of Petroleum Resources. The Energy Journal Volume 30:141–174

- ↑ BGR (2010) Reserven, Ressourcen und Verfügbarkeit von Energierohstoffen 2010 - Kurzstudie. Bundesanstalt für Geowissenschaften und Rohstoffe (BGR), Hannover, Germany

- ↑ Rogner H-H, Aguilera RF, Archer CL, et al (2012) Chapter 7: Energy Resources and Potentials. In: Zou J (ed) Global Energy Assessment - Toward a Sustainable Future. Cambridge University Press, Cambridge, UK, pp 425–512

- ↑ IHS CERA (2012) Upstream Capital Cost Index (UCCI) and Upstream Operating Cost Index (UOCI). In: IHS Indexes. http://www.ihs.com/info/cera/ihsindexes/index.aspx. Accessed 20 Nov 2012

- ↑ Rogner H-H, Aguilera RF, Archer CL, et al (2012) Chapter 7: Energy Resources and Potentials. In: Zou J (ed) Global Energy Assessment - Toward a Sustainable Future. Cambridge University Press, Cambridge, UK, pp 425–512

- ↑ Bauer et al. under review

- ↑ NEA (2009) Uranium 2009: Resources, Production and Demand. OECD

- ↑ IEA (2008a) World Energy Outlook 2008. International Energy Agency

- ↑ IEA (2009) World Energy Outlook 2009. International Energy Agency, Paris, France

- ↑ Dahl C, Duggan TE (1998) Survey of price elasticities from economic exploration models of US oil and gas supply. Journal of Energy Finance & Development 3:129–169. doi: 10.1016/S1085-7443(99)80072-6

- ↑ Krichene N (2002) World crude oil and natural gas: a demand and supply model. Energy Economics 24:557–576. doi: 10.1016/S0140-9883(02)00061-0

- ↑ Askari H, Krichene N (2010) An oil demand and supply model incorporating monetary policy. Energy 35:2013–2021. doi: 10.1016/j.energy.2010.01.017