Fossil energy resources - POLES: Difference between revisions

No edit summary |

mNo edit summary |

||

| Line 14: | Line 14: | ||

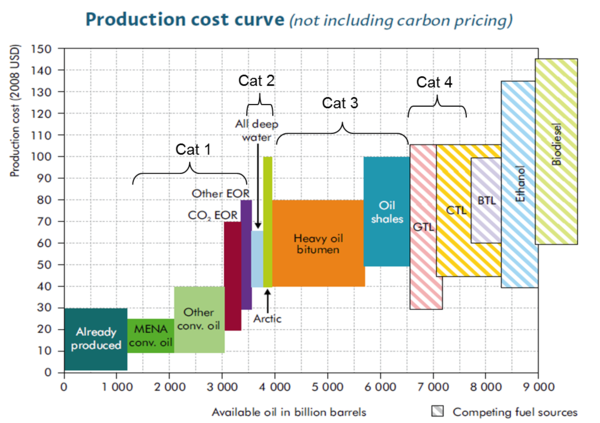

[[File:36405505.png|none|600px|thumb|<caption>Static aggregated oil production cost curve</caption>]] | [[File:36405505.png|none|600px|thumb|<caption>Static aggregated oil production cost curve</caption>]] | ||

While this figure gives an aggregated static cost curve, the model actually uses ''dynamic'' cost curve per resource type integrating the cost of energy needs for production for each production country/ region. Consequently POLES fossil fuel cost curves thus evolve over time, by region and with the scenario settings (for instance: a CO2 pricing will affect the production cost of tar sands | While this figure gives an aggregated static cost curve, the model actually uses ''dynamic'' cost curve per resource type integrating the cost of energy needs for production for each production country/ region. Consequently POLES fossil fuel cost curves thus evolve over time, by region and with the scenario settings (for instance: a CO2 pricing will affect the production cost of tar sands). | ||

The supply module transforms resources into reserves through discovery effort (exploration and drilling) that depends on remaining resources, the (dynamic) production cost curve and international fuel prices, through elasticities that capture openness to investment and resource management strategies. | The supply module transforms resources into reserves through discovery effort (exploration and drilling) that depends on remaining resources, the (dynamic) production cost curve and international fuel prices, through elasticities that capture openness to investment and resource management strategies. | ||

| Line 20: | Line 20: | ||

Reserves are then turn into production depending on remaining reserves, the (dynamic) production cost curve and international fuels prices. | Reserves are then turn into production depending on remaining reserves, the (dynamic) production cost curve and international fuels prices. | ||

<figure id="fig:POLES_5"> | |||

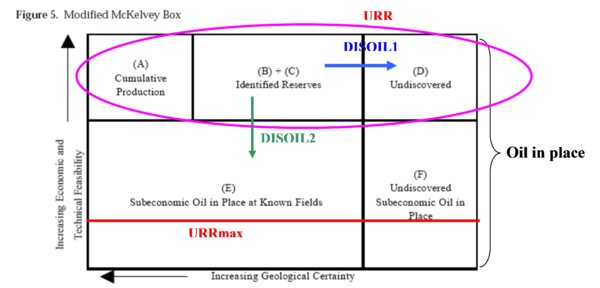

[[File:36405504.png|none|600px|thumb|<caption>Reserves discovery process in POLES (URR: ultimate Recoverable Resources, DISOIL: Discovery of oil)</caption>]] | [[File:36405504.png|none|600px|thumb|<caption>Reserves discovery process in POLES (URR: ultimate Recoverable Resources, DISOIL: Discovery of oil)</caption>]] | ||

</figure> | |||

Sources of information include: BGR, USGS, IEA, MIT, industry estimates | Sources of information include: BGR, USGS, IEA, MIT, industry estimates | ||

Revision as of 15:38, 22 December 2016

| Corresponding documentation | |

|---|---|

| Previous versions | |

| Model information | |

| Model link | |

| Institution | JRC - Joint Research Centre - European Commission (EC-JRC), Belgium, http://ec.europa.eu/jrc/en/. |

| Solution concept | Partial equilibrium (price elastic demand) |

| Solution method | SimulationRecursive simulation |

| Anticipation | Myopic |

The POLES model differentiates various types of fossil fuels:

- oil: conventional, tar, heavy and oil shale / onland & shallow, deepwater, artic;

- gas: conventional, shale gas / onland & shallow, deepwater and artic;

- coal: steam and coke.

The description below gives elements for oil, but they can be extended to gas and coal.

While this figure gives an aggregated static cost curve, the model actually uses dynamic cost curve per resource type integrating the cost of energy needs for production for each production country/ region. Consequently POLES fossil fuel cost curves thus evolve over time, by region and with the scenario settings (for instance: a CO2 pricing will affect the production cost of tar sands).

The supply module transforms resources into reserves through discovery effort (exploration and drilling) that depends on remaining resources, the (dynamic) production cost curve and international fuel prices, through elasticities that capture openness to investment and resource management strategies.

Reserves are then turn into production depending on remaining reserves, the (dynamic) production cost curve and international fuels prices.

<figure id="fig:POLES_5">

</figure>

Sources of information include: BGR, USGS, IEA, MIT, industry estimates